Collect information about any employers and sources of income over the past 18 months. The amount the state pays is based on a complicated formula that looks at your highest paid quarter over the past 4 to 6 quarters. You can find more information

here.

Prepare to wait. After you file for SDI and/or PFL, the process can take a few weeks while the Employment Development Department (EDD) reviews your application.

Provide confirmation of your weekly benefit rate to your employer or leave and claims administrator. If your company works with Parento, also provide a copy to the Parento Leave Concierge team.

Your company may choose not to pay you paid parental leave while you’re waiting for the approval from the state for PFL. While you may be eligible for parental leave pay, you may see a delay. If you have concerns, reach out to your company.

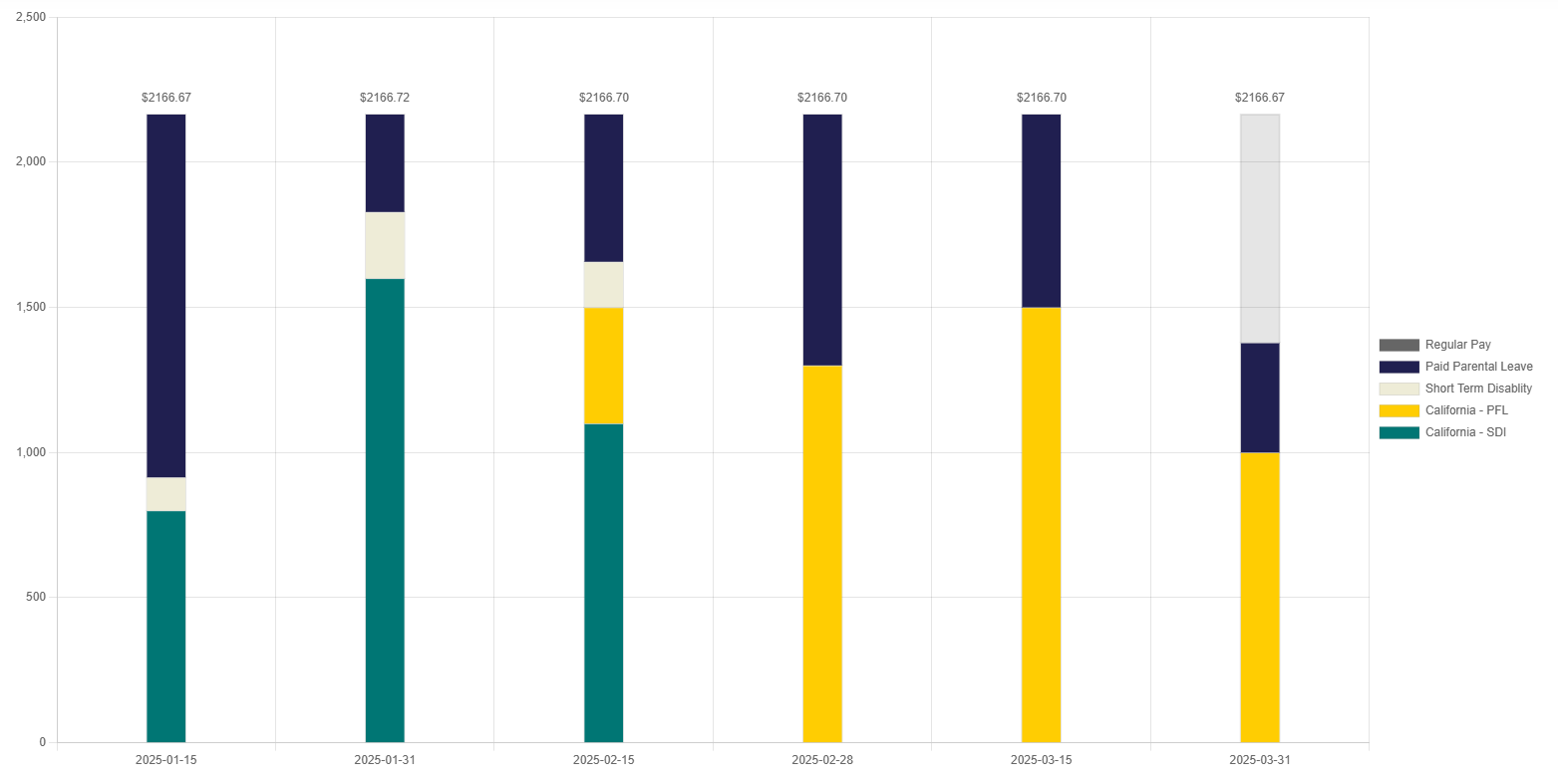

While you are considered disabled, you may be eligible for SDI from the State of California EDD. These benefits are payable once you stop working and continue while you recover from birth (i.e., 6 weeks for a natural birth or 8 weeks for a C-section). Since each pregnancy and delivery is different, your healthcare provider will need to complete medical certification for your claim.

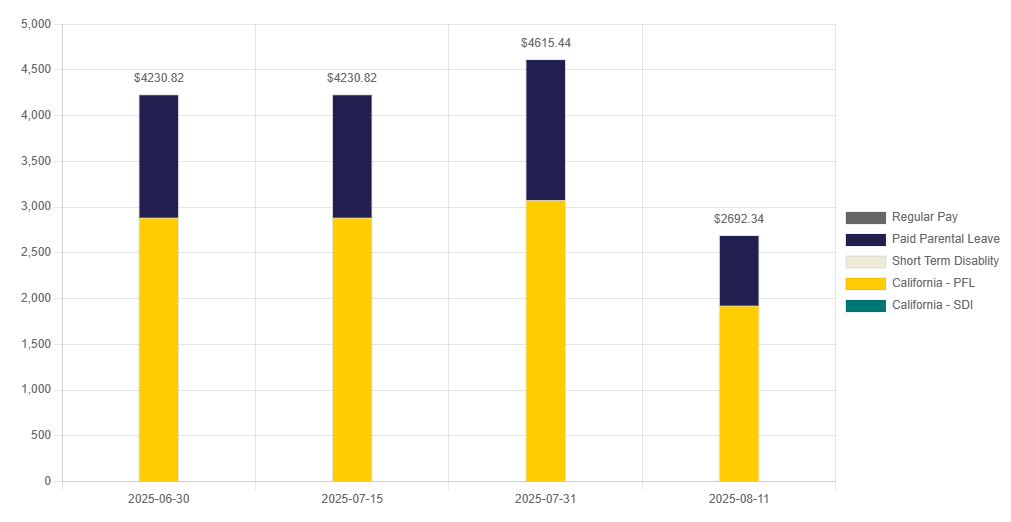

Once you are no longer disabled, you may be eligible for up to 8 weeks of Paid Family Leave (PFL) benefits. Generally, the EDD will send you information on how to file. If you have questions on filing for PFL, you can click here.

If your employer has a private STD policy, you will also need to file for those benefits. Keep in mind, STD benefits are reduced by what you receive from the EDD. That means you may or may not receive benefits from STD, depending on how much you receive from the EDD. For more information, please refer to your employer’s STD policy.

Your company will cover the difference between what SDI, STD, and PFL pay to the limits of the paid parental leave policy. It is important that you file for these benefits as soon as possible to avoid delays in pay.